inheritance tax malaysia

Short title and application 2. At the time assets of a deceased.

Gini Coefficients Before And After Taxes And Transfers In Oecd Download Scientific Diagram

Web Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax.

. Web LAWS OF MALAYSIA Act 39 INHERITANCE FAMILY PROVISION ARRANGEMENT OF SECTIONS ACT 1971 Section 1. Web Procedures For Submission Of Real Property Gains Tax Form Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only TRANSFER OF ASSET INHERITED FROM. Web Inheritance Inheritance tax and inheritance law in Malaysia Taxation Researcher April 04 2022 INHERITANCE No inheritance or gift taxes are levied in.

This table provides an overview only. Has inheritance tax to be paid whereas Malaysia has zero inheritance tax payable which facilitates ease of distribution of ones Malaysian estate. Now by compounding an annual real inflation rate of 55 from 1977 until.

Web 151 rows The headline inheritance and gift rates are generally the highest statutory rates. Web THE launch of the Shared Prosperity Vision 2030 signalled a new era of development in Malaysia. Web Under the Distribution Act should your mum pass away leaving three children and your dad and no parents your dad is entitled to 13 of the share and the three children.

MYR 5 per person. By compounding this 35 rate. However it was abolished 1991.

Web Currently Malaysia does not have any form of death tax estate duty or inheritance tax. See the territory summaries for more detailed. Web Most people would say a range from at least 5 to 6 and we will use 55 as a mid-point.

Web In the present context the inheritance tax rate for Malaysia should now be at least 50 percent for estates valued at between RM2 million to RM3 million with a. Sources said both capital gains tax CGT and inheritance tax. The prime reason was due to poor tax collection as the tax was only applicable to a specific threshold and was.

The much-speculated taxes on capital gains and inheritance will not be introduced in Budget 2019. Web Inheritance tax in Malaysia was abolished back in 1991. Web We do not have the inflation rate of Malaysia from 1977 until 2020 but for arguments sake we will use a prudent rate of 35.

Web In addition UK. There was an estate duty in place until 1 November 1991 when it was abolished.

On Last Few Weeks 20hb July Sell Back Physical Gold Bar With Affin Bank The Bank Buy Back Policy And Procedure Quite Simple Com Physics Gold Bar Finance Tips

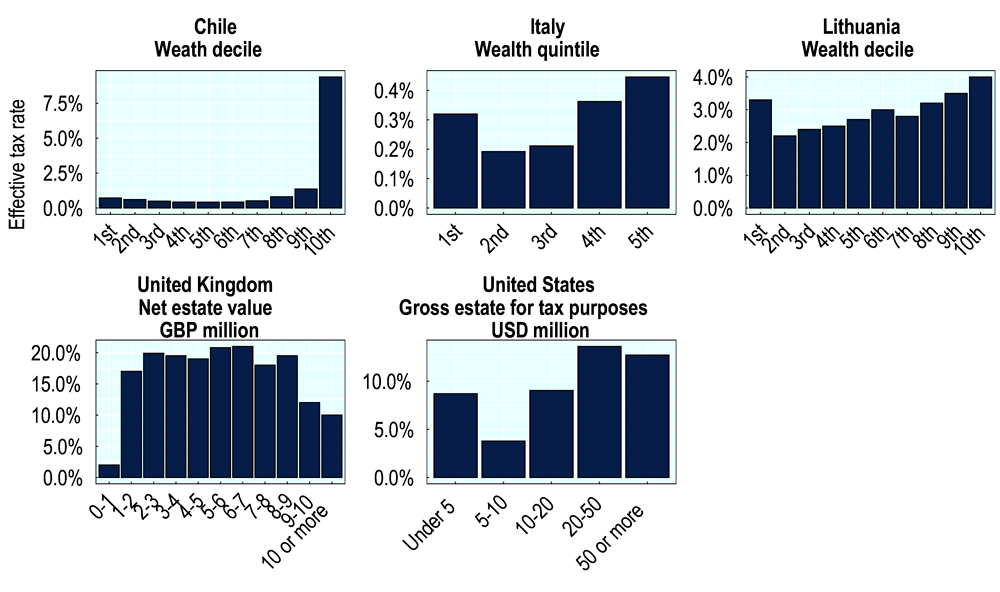

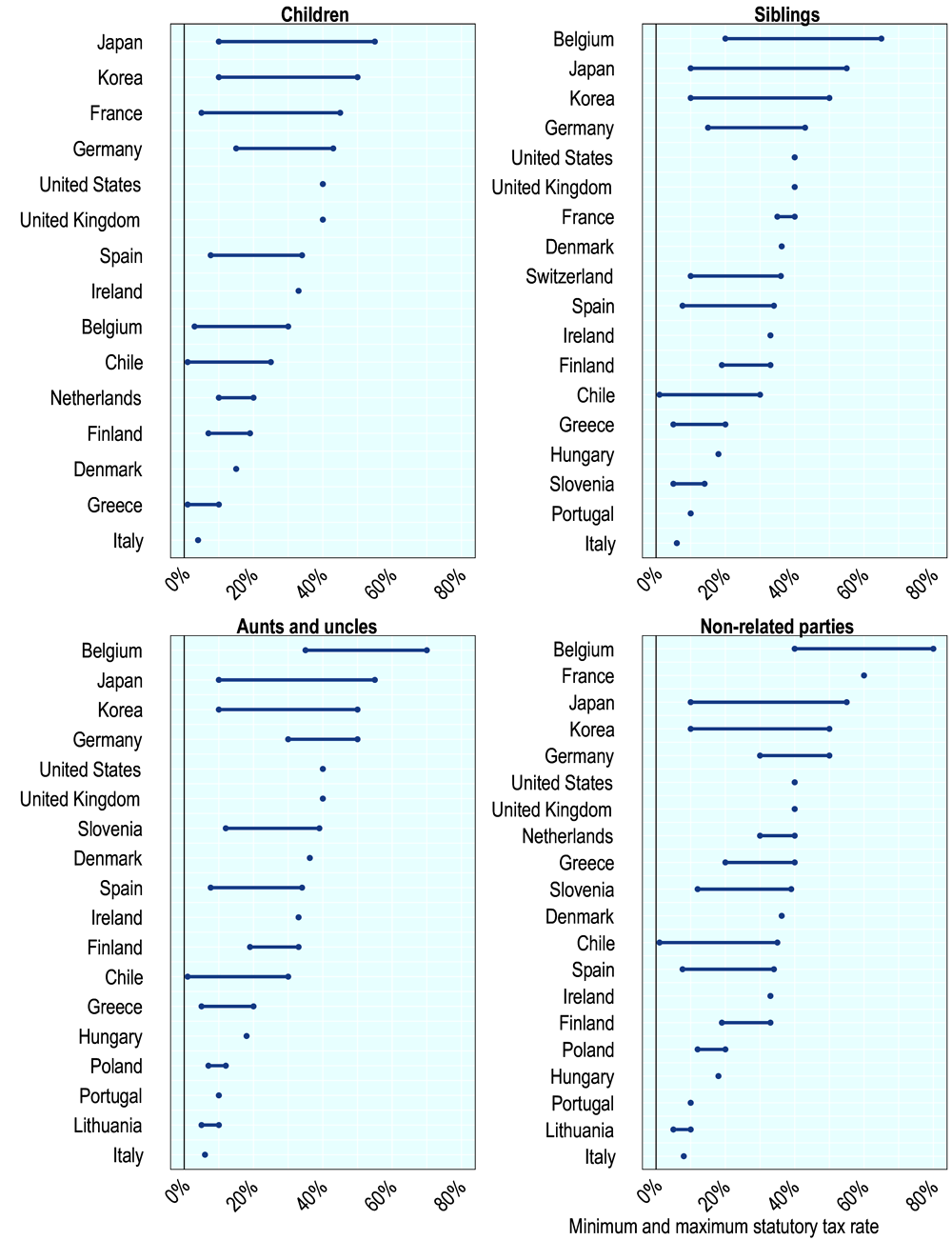

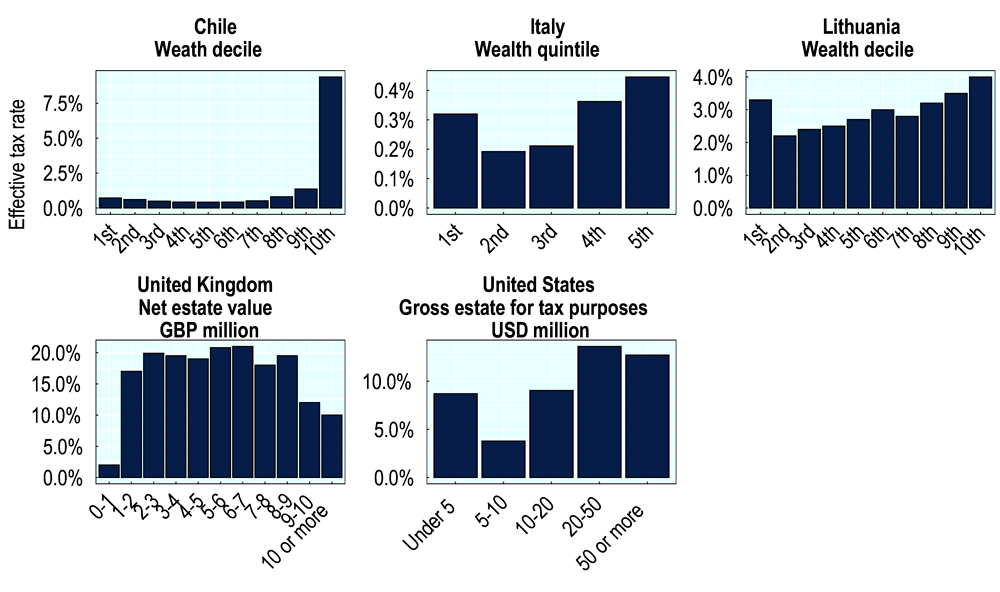

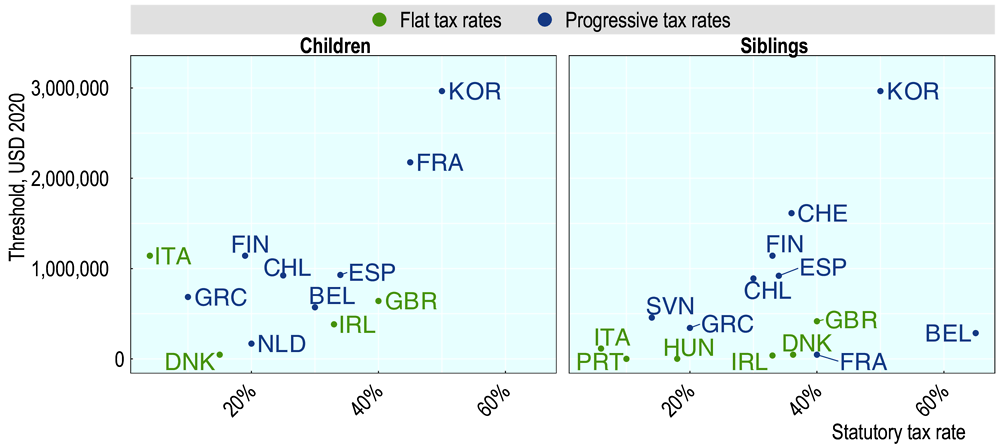

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

Tax Experts No Need For Capital Gains Inheritance Taxes

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Do I Need Life Insurance Joanne Dewberry Uk Small Business Blog Life Insurance Marketing Life Insurance Marketing Ideas Life Insurance Sales

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Understanding Inheritance And Estate Tax In Asean Asean Business News

1 Nov 2018 Budgeting Inheritance Tax Finance

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Budget 2020 It S Time For Wealth And Inheritance Tax

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

Bkash Mobile Money Job Opening Good Communication Skills Job

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Inheritance Taxation In Oecd Countries En Oecd

Comments

Post a Comment